Additional Info

Malaysia is committed to continuously developing and upgrading its infrastructure. This has resulted in over 500 dedicated industrial parks, specialized industrial parks and free industrial zones, expanding telecommunication technologies, growing network of highways, efficient seaports and well – recognized international airports.

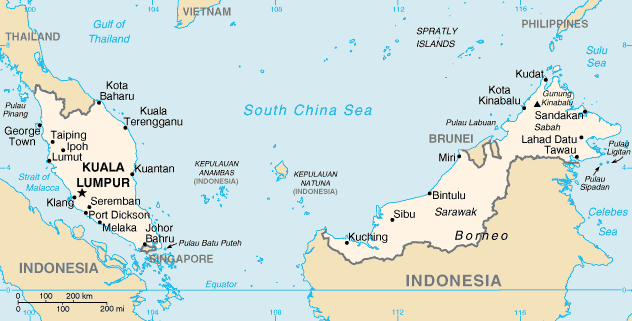

Click on the icon to download a map of Malaysia with major infrastructure facilities.

Source: MIDA

The Guide to Malaysia by MDBC member Leisure Guide Publishing.

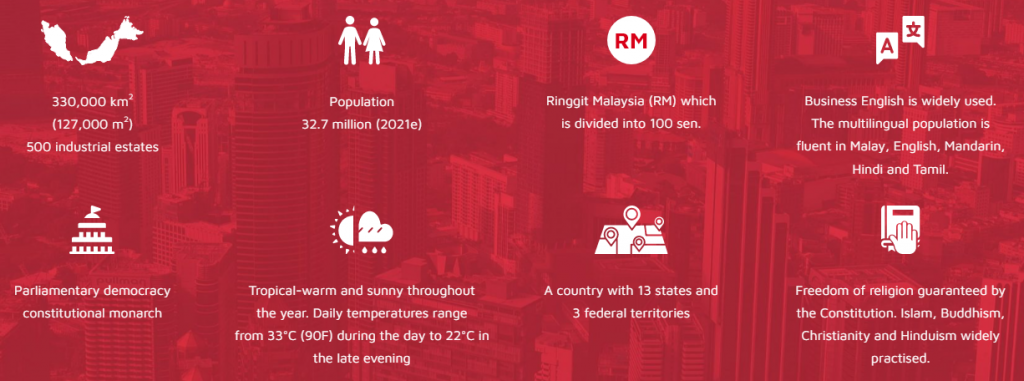

Malaysia lies just above the equator, right in the heart of South – East Asia. Strategically located between the Indian Ocean and the South China Sea, Malaysia is well serviced by all primary air and shipping lines. This, coupled with the country’s sustainable and solid economic foundation, comprehensive business ready environment, future – forward focus, and dynamic skilled workforce, have made Malaysia an attractive cost – competitive investment location in the region that is fast becoming a preferred center for shared services and leading technology industries.

Source: MIDA

Secure Economic Foundations

Malaysia has a highly – diversified economic and export structure, supportive labor market, low and stable inflation, a strong and well – capitalized financial sector, and a healthy current account of the balance of payments.

Malaysia’s Key Economic Indicators (2021e):

Gross Domestic Product (GDP): RM 370.7 billion / RM 357.9 billion (2020)

Real GDP Growth (%): 3.1% / -5.6% (2020)

GNI Per Capita (In Current Prices): RM 45.1 billion / RM 42.6 billion (2020)

Inflation: 2.4% / – 1.2 % (2020)

Unemployment Rate: 4.2% / 4.5 % (2020)

International Reserves: USD $116.3 billion

2020 Figures:

Gross Domestic Product (GDP): RM 357.9 billion (2020)

Real GDP Growth (%): -5.6% (2020)

GNI Per Capita (In Current Prices): RM 42.6 billion (2020)

Inflation: 2.4% / – 1.2 % (2020)

Unemployment Rate: 4.5 % (2020)

International Reserves: USD $107.7 billion (2020)

Source: MIDA

Please click here to view the latest Key Economic Indicators.

From a country once dependent on agriculture and primary commodities, Malaysia has become an export – driven diversified economy spurred on by high technology, knowledge – based, and capital – intensive industries. Their mature and integrated ecosystems developed over the decades nurtured a strong local supply chain that supports the long term growth of your business.

Heart of South – East Asia

- The average ASEAN GDP growth is expected to expand by 5.2% in 2022 and 5.3% in 2023

Source: Asian Development Outlook, 2022 - Centre of South – East Asia.

Market access of over 650 million people with combined GDP of US$3.2 trillion

Source: ASEANstats, 2021 - Well – connected to major ports in Asia.

Reaching Mumbai, India within six (6) hours and reaching Beijing, China within nine (9) hours - Next to one of the world’s busiest shipping lanes.

Straits of Malacca provides access to global supply chains via two key ports.

Gateway to ASEAN and Beyond

- Malaysia is a market – oriented economy with 16 Free Trade Agreements

Creating potential market size of 4 billion people - Lower cost of doing business

Almost 99% of products in ASEAN have zero tariffs - Attract 31% of Global FDI

Global market size is estimated to attract 31% of Global FDI - World’s 3rd Largest Workforce

ASEAN has the world’s third largest labor force and a growing middle class – a powerful engine for long term growth - Largest FDI inflow of any emerging market region

Continues to be an engine of growth for FDI in Asia and globally

Source: UNCTAD’s 2021 Investment Trends Monitor

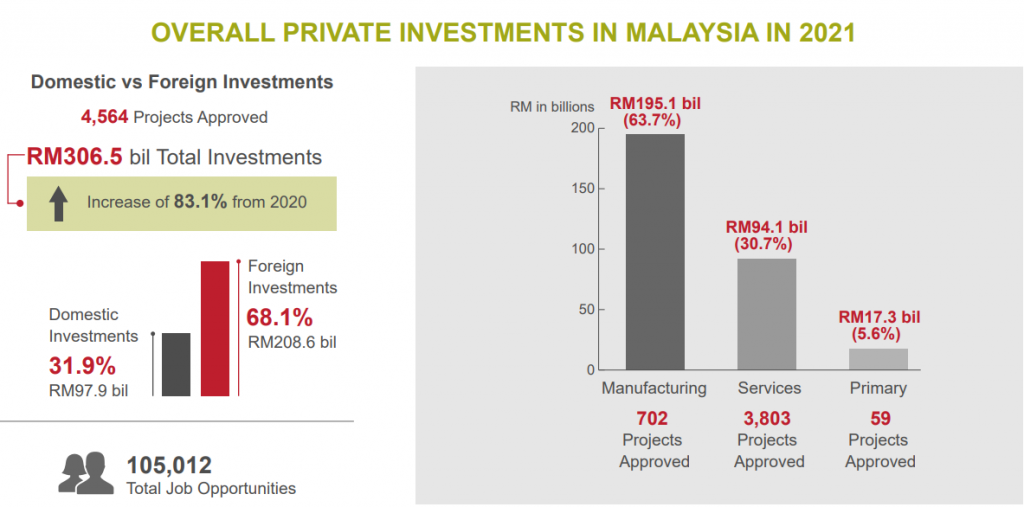

Source: Malaysia Investment Performance Report, 2021

Malaysia’s manufacturing sector plays an important role in the global supply chain while domestic activities are well represented by the services sector, which has gained greater prominence in the past two decades.

They continue to be an attractive location for businesses across various industries. Malaysia’s diversified sectors offer abundant opportunities for investors expanding into alternative markets.

Source: MIDA

Extensive Trade Links, Lower Cost of Doing Business

Malaysia has already signed and implemented various free trade agreements (FTA), which include bilateral FTAs with Japan, Pakistan, India, New Zealand, Chile, Australia, and Turkey. On the ASEAN level, Malaysia has regional FTAs through the ASEAN Free Trade Agreement (AFTA) with China, Korea, Japan, Australia, New Zealand, and India.

This creates a potential market size of more than 4 billion people globally. Up to 98% of total products have 0% import duties under Malaysia’s FTAs with ASEAN.

Lower trade barriers translate to lower costs of doing business. This grants companies operating in Malaysia preferential access to capture growth opportunities and immediate markets in one of the world’s largest trading blocs.

Higher Investment Opportunities via RCEP

Malaysia is among the 10 signatory countries of the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade agreement. RCEP represents 30% of the world’s population and collectively contributes to 30% of global economic activities, as measured by GDP. This is expected to establish a strong framework for cooperation and contribute significantly to economic recovery for the economies involved. Given that the member countries of RCEP are among Malaysia’s top 15 trading partners, this free trade agreement is expected to create a more liberal, facilitative and competitive investment environment that will provide improved investment facilitation and investor aftercare.

RCEP will immensely open a new window of opportunities for trade and investments, fortifying connectivity and deepening regional economic integration, which will further accelerate the region’s economic recovery.

Discover More Investment Opportunities

Over the past decades, the manufacturing sector has undergone momentous changes. Production efficiency and cost control are vital factors that enable the sector to deliver real results to your business. The Malaysian services industry also combines a multidisciplinary approach with in – depth, practical industry knowledge to meet challenges and seize opportunities. Explore the various competitive and comparative advantages in Malaysia’s manufacturing and services sectors.

Manufacturing Sector

* Building Technology

* Chemical & Advanced Materials

* Electrical & Electronics

* Food Technology

* Lifestyle

* Life Sciences & Medical Technology

* Machinery & Metal

* Paper, Printing, and Publishing

* Transportation Technology

* Wood – Based and Furniture

Services Sector

* Business Services

* Education Services

* Green Technology

* Healthcare Services

* Hospitality (Hotels and Tourism)

* Logistics Services

* Oil & Gas

* Regional Establishment

* Research & Development (R&D)

* Other Services

Source: MIDA

It is easy for you to start and scale – up your business smoothly in Malaysia. Malaysia’s established financial and banking sectors, business – friendly policies, ready infrastructure, and supportive government facilities make it straightforward for companies to set up operations here. The World Competitiveness Yearbook 2021 has ranked Malaysia’s global competitiveness at 25th place out of 64 economies, an improvement from the 27th position in 2020.

Malaysia is well – positioned to serve as a central hub for worldwide trade. Their air transport infrastructure is among the best in the world. Their coastal ports provide direct maritime access in Asia to Singapore, China, as well as to Europe and the U.S. Malaysia also offers investors a selection of secure trade corridors and industrial zones that regularly facilitate continual supply chain and business operations.

Their policies continue to be pro – business, prudent, and pragmatic to create an environment that is safe, secure, and scalable for the long term success of businesses here. This includes 100% equity ownership in the manufacturing and selected services sectors, competitive investment incentives, and IP protection laws that conform with international standards.

Malaysia’s Global Standing

Take a look at how Malaysia stacks up against the global competition. Their efforts in attracting investments and driving productivity and innovation through economic and regulatory reforms have received worldwide recognition by various international institutions.

1st – Top country in emerging Southeast Asia for Foreign Investment

(Global Opportunity Index, Bloomberg 2022)

4th – Most Competitive Emerging Market

(Agility Emerging Markets Logistics Index 2022)

2nd – Most Competitive Country in ASEAN

(World Competitiveness Yearbook 2021, IMD)

Progressive Infrastructure, Excellent Connectivity

Malaysia has the perfect combination of world – class infrastructure components to maneuver people and goods around the country quickly and affordably. Their fiber optic technology, international airports, and seaports, as well as well – maintained highways make Malaysia an ideal access point to the Asia – Pacific market.

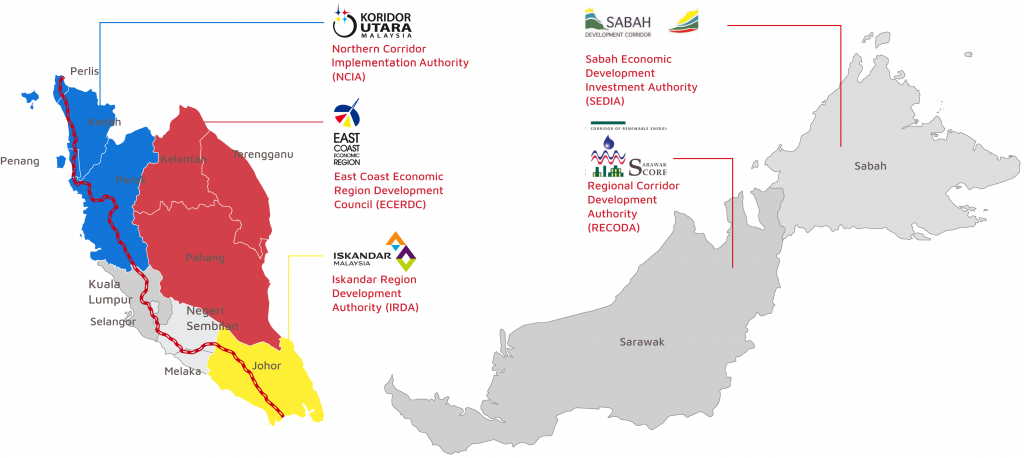

Industrial parks are continuously being developed by state governments as well as private developers to meet industry’s demands. Malaysia’s economic corridors complement MIDA’s efforts to attract strategic partners to invest in their respective regions.

Companies in FIZs are allowed duty free imports of raw materials, components, parts, machinery and equipment directly required in the manufacturing process. In areas where FIZs are not available, companies may apply to set up Licensed Manufacturing Warehouses (LMWs).

Specialized parks are developed to cater to the needs of specific industries. These include Technology Park Malaysia in Bukit Jalil, Kuala Lumpur, and the Kulim Hi – Tech Park in the northern state of Kedah which also caters to technology – intensive industries and R&D activities.

Liberal Equity Policy

Malaysia’s liberal equity policy makes it easier for foreign companies to set up their business here to stay ahead. Since June 2003, foreign investors have been able to hold 100% of the equity in all investments in new and expansion / diversification projects in the manufacturing sector and selected services sectors. Liberalized services sub – sectors include selected areas of health and social services, tourism services, transport services, business services, and computer and related services.

Intellectual Property (IP) Protection

Malaysia’s IP laws are in conformance with international standards

- Member of the World Intellectual Property Protection Organization (WIPO)

- Signatory of the Paris Convention and Berne Convention which governs IP rights

- Signatory of the Agreement on Trade – Related Aspects of IP Rights (TRIP 8) under the WTO

Malaysia has signed Investment Guarantee Agreements (IGAs) with more than 60 countries.

The world’s most innovative companies choose Malaysia due to their secure Intellectual Property (IP) protections which safeguard more than just their ideas or concepts. It protects their genuine business assets that are integral to the core services of the business and overall long – term viability. Malaysia’s robust Intellectual Property (IP) laws will secure all of your innovations.

Conducive Business Environment in Malaysia

The conducive business environment in Malaysia has made the country one of the world’s top investment destinations for offshore manufacturing operations. Malaysia has to date attracted more than 5,000 foreign companies from more than 50 countries to establish their operations in the country. Many companies continue to expand and diversify operations in the country, reflecting ongoing confidence in Malaysia as a preferred site for their business ventures.

Convergence of Traditional Services Hubs

Today, Malaysia has enticed a hybrid suite of business models from Global / Regional Headquarters, Centers of Excellence (COEs), to Procurement and Distribution Hubs. Malaysia holds many attractions for MNCs looking to tap into a strategic location within Asia Pacific for their services operations to support the management of their regional or global supply chains.

Approved Regional and Global Operations (as of December 2020):

– 839 Projects

– 100 Countries

– 104,667 Jobs

– USD $ 14.3 billion in Investments

National Investment Aspirations (NIA)

The NIA is a forward-looking growth framework that will form the basis for comprehensive reforms of Malaysia’s investment policies. It will focus on coherence and cohesiveness, with these aspirations being reflected across all national policy documents and initiatives related to investment, including the new Industrial Masterplan and the 12th Malaysia Plan. It plays an important role in revitalizing Malaysia’s investment climate, attract high quality investments into the country and create high income jobs, particularly in a post – COVID era.

Five Core Parameters Framing the NIA:

- Increase the Economic Complexity:

Increase economic diversity and complexity through the development of sophisticated products and services, with local Research and Development (R&D) and innovation. - Create High – Value Jobs:

Create high skill jobs to provide better income for the people. - Extend Domestic Linkages:

Expand and integrate domestic linkages into regional and global supply chains, by improving their resiliency. - Develop New and Existing Clusters:

Develop new and existing clusters focusing on high productivity sectors, including local products and services - Improve Inclusivity:

Improve inclusivity to contribute towards the socio – economic developmental agenda

The NIA is expected to propel long term growth for Malaysia through the flow of sustainable quality investment in new and complex growth areas. Given its decades of investment promotion and facilitation track record, MIDA will be assuming a more prominent role in this initiative as part of institutional reforms and in line with the NIA mandate for better policy coherence.

More information on NIA can be read here.

Positioning a Sustainable Malaysia

Under the NIA, investment strategies will prioritize investments and innovation that strike a balance between economic and environmental sustainability anchored on global environmental, social and governance (ESG) benchmarks to support growth along the supply and value chains.

The green initiatives under Budget 2022 include reinforcing the need for Malaysian companies and the local supply chain to adopt ESG frameworks premised on higher value creation.

The transforming strategic sectors that have been identified following ESG – based practices include:

- Manufacturing

Transformation to drive increased manufacturing of sustainable products e.g. EVs and adoption of ESG practices such as having a positive social impact - Services

Incorporation of the latest ESG practices into services such as corporate governance standards and sustainable investing - High – tech areas

Integration of advanced technologies with the latest ESG trends such as green data centers - Energy and Power

Accelerated transition of energy and utility industries towards renewable sources

Source: MIDA

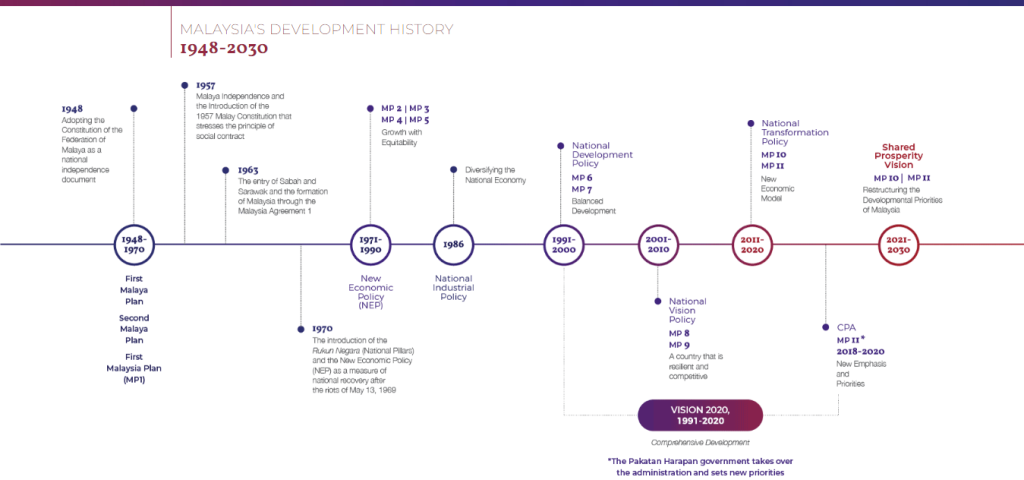

The 12th Malaysia Plan (12MP) is the first phase of Malaysia’s Shared Prosperity Vision 2030 (SPV 2030) towards restructuring Malaysia into a knowledge – based economy that achieves sustainable growth across income groups, ethnicities, regions, and supply chains.

The 12MP’s policies, programs and initiatives revolve around three main dimensions, namely, Economic Empowerment, Environmental Sustainability, and Social Reengineering. These dimensions will complement each other towards realizing the country’s development model of Shared Prosperity. They are also in line with Malaysia’s efforts to attain the Sustainable Development Goals by 2030. Updates and further information can be found in the Official Portal of the Economic Planning Unit.

Click on the following to download info related to the 12MP

Source: Economic Planning Unit

It’s easy to do business in Malaysia. Here are some guidelines to help you get started on your business ventures in Malaysia.

Make Key Connections

- Become a member of MDBC

- Connect with MIDA

Identify Business Requirements

Investment Opportunities

Explore various investment opportunities in Malaysia’s robust industries and sub – sectors.

Equity Policy and Protection of Foreign Investment

The Government encourages joint – ventures / partnership between Malaysian and foreign investors.

Approval and Licensing

Guideline on getting your investment approved and obtaining the necessary license.

Promoted Activities

List of promoted activities and products which are eligible for consideration of tax incentives.

Incentives

Tax incentives, both direct and indirect, are just another tool to provide a tipping point in promoting investments.

Registration of Business Entity

Companies doing business in Malaysia must register with the Companies Commission of Malaysia (SSM).

Market Rate of Business Space

Office space for a start up or a state – of – the – art factory, Malaysia has solutions for you.

Taxation

Income derived from Malaysia is subject to income tax. Find out the taxation requirements.

Banking, Finance, and Exchange Administration

The Malaysian financial system comprises a diversified range of institutions to serve the increasingly more varied and complex needs of the domestic economy.

Intellectual Property Regulations and Protection

Malaysia’s intellectual property laws are in conformance with international standards.

Environmental Management

Investors are encouraged to consider the environmental factors during the early stages of their project planning.

Infrastructure Support

Malaysia is continuously enhancing its infrastructure to provide a conducive business environment. Get a macro view on the infrastructure support that are available for your business.

Workforce, Visa, and Immigration

Grow your business with educated local talent or international professionals with MIDA’s assistance.

Conditions of Employment

To cater to the manufacturing sector’s expanding demand for technically trained workers, the Malaysian Government has taken measures to increase the number of skilled workers.

Learning and Development

The Government’s initiatives in producing a sustainable supply of skilled workers for the industries.

Wage Rate

Labor costs in Malaysia are kept relatively competitive while productivity levels remain high in comparison with most other industrialized countries.

Human Resources Development Fund

To catalyze the development of a competent local workforce that will contribute to Malaysia’s vision of becoming a high – income economy.

Statutory Contributions

In Malaysia, “Statutory Contributions” includes Employees Provident Fund (EPF) and Social Security Organization (SOCSO).

Employment of Expatriates

While companies are allowed to bring in expatriate personnel, it is highly encouraged for companies to train up local talents.

Entering Malaysia

All persons entering Malaysia must possess valid national passports or other internationally recognized Travel Documents valid for travelling to Malaysia.

Employment of Workers

Foreign workers can be employed in the manufacturing, construction, plantation, agricultural, services, and domestic help sectors.

Harmonious Industrial Relations

Overview of the industrial relations in Malaysia.

Facilities for Recruitment

Employers and job seekers can register for free at the MYFutureJobs portal to seek suitable candidates and positions.

Project Implementation and Compliance

Post Approvals and Post Invest Requirements

To enjoy the benefits of the support received in the form of tax incentives or other schemes, companies are required to implement their project within 24 months of approval and adhere to incentive conditions for their projects.

Business Expansion

Expand, Diversify, and Reinvest

Companies that seek to leverage on Malaysia’s growing competitiveness by expanding and diversifying their operations will continue to receive MIDA’s dedicated facilitation and consultation services.

Source: MIDA

The greatest advantage to manufacturers in Malaysia has been the nation’s persistent drive to develop and upgrade its infrastructure. Over the years, these investments have paid off and serious bottlenecks have been avoided. Today, Malaysia can boast of having one of the most well – developed infrastructure among the newly industrializing countries of Asia.

The development of Kuala Lumpur Sentral, a futuristic self – contained city, providing the perfect live, work, and play environment. A modern transportation hub integrating all major rail transport networks, including the Express Rail Link to KLIA and Putrajaya, the government’s new administrative center. The transport facilities offered are on par with the best the world over.

NETWORK OF HIGHWAYS

Peninsular Malaysia’s network of well – maintained highways is a boon to industries. These highways link major growth centers to seaports and airports throughout the peninsular and provide an efficient means of transportation for goods. To complement these highways, a Kuala Lumpur – Bangkok – Kuala Lumpur containerised service known as the ASEAN Rail Express (ARX) has been initiated with the aim of expanding it to become the Trans – Asia Rail Link that will include Singapore, Vietnam, Cambodia, Laos, and Myanmar before ending up in Kunming, China.

EFFICIENT SEAPORTS

International trade, especially seaborne trade, has traditionally been the lifeblood of Malaysia. Today, more than 90% of the country’s trade is by sea via Malaysia’s seven international ports namely Penang Port, Port Klang, Johor Port, Port of Tanjung Pelepas, Kuantan Port, and Kemaman Port in Peninsular Malaysia, and Bintulu Port in Sarawak. All of these ports are equipped with modern facilities. Bintulu Port handles liquified natural gas.

In tandem with the expansion of the economy and trade, ports in the country have registered impressive growth in recent years. Two of the ports, Port Klang and the Port of Tanjung Pelepas (PTP), are ranked among the top 20 container ports in the world. Port Klang has been made the national load center and the transshipment center, whereas PTP has been recognized as a regional transshipment hub.

INTERNATIONAL AIRPORTS

Malaysia’s central location in the Asia Pacific region makes her an ideal gateway to Asia. Air cargo facilities are well – developed in the six international airports – The Kuala Lumpur International Airport (KLIA), Penang International Airport, Langkawi International Airport, and Senai International Airport in Peninsular Malaysia, Kota Kinabalu International Airport in Sabah, and Kuching International Airport in Sarawak.

Malaysia’s biggest airport – KLIA, surrounded by four main cities – Kuala Lumpur, Shah Alam, Seremban, and Melaka, has a capacity of handling 40 million passengers and more than 1.2 million tonnes of cargo per year. Cargo import and export procedures are fully automated to cut down delivery time.

Malaysia is among the most friendly and hospitable places in the world to work and live in. In addition, the country’s tropical climate with its uniform temperatures allows light, comfortable clothing throughout the year. Expatriates and their families will enjoy a safe and comfortable living environment with 21st century amenities, good healthcare and medical facilities, excellent educational institutions, and world – class recreational and sports facilities – at costs much lower than in their own countries.

One of the country’s most distinctive features is its rich diversity of cultures, a heritage derived from its racial mix of some of the world’s oldest civilizations – Malay, Chinese, and Indian. This potpourri of race and culture has enabled Malaysians to speak at least two, and even three languages – Malay (the national language), English, and their own mother tongue. Living in such a cosmopolitan environment, Malaysians are warm, friendly people who easily accept foreigners into their circle of friends.

COMFORTABLE HOUSING

There is a wide selection of comfortable housing in Malaysia. According to a survey on expatriate living costs by the Malaysian International Chamber of Commerce & Industry, monthly rentals for accommodation can range from as low as RM 2,500 – RM 3,800 for a furnished 3 – bedroom condominium in the suburbs of Kuala Lumpur, to approximately RM 15,000 for a luxury bungalow in a posh neighborhood nearer to the city.

INTERNATIONAL SCHOOLS

There are over 30 international schools registered with the Ministry of Education. These schools are located in the federal territories of Kuala Lumpur and Labuan, and in the states of Selangor, Johor, Kedah, Kelantan, Melaka, Negeri Sembilan, Pahang, Penang, Perak, Sabah, and Sarawak. They include American and British style international schools as well as French, German, Japanese, and Taiwanese schools that have facilities for pre – school to college education.

UNSURPASSED LIFESTYLE

Life in Malaysia is an adventure. The year – long warm and sunny climate offers an unsurpassed lifestyle, especially for people who love the outdoors. Families can spend an exciting weekend at Malaysia’s national parks with their magnificent rivers and mountains, fly to one of the many island retreats for snorkeling and scuba diving, or drive for a game of golf in a cool hill resort. For people who prefer the indoors, they can shop until they drop in ultra- modern shopping complexes that offer the latest in designer fashions, leather goods, and electronic items at very competitive prices.