MDBC

[MDBC] 8 Ways to Get More Out of Your Council Membership

There are many reasons to join the Malaysian Dutch Business Council (MDBC). There are networking opportunities, community involvement, and the trust that affiliation with our Business Council builds within the market. There are many additional benefits that you can receive from being an MDBC member, but sometimes, our members need extra support to get the maximum benefit out of this community. It’s easy to assume that by simply paying the annual membership dues, new business opportunities, potential joint ventures, and higher brand recognition will occur. In order to help you maximize your benefits and make the MDBC experience work for you, learn how to get the most out of your membership.

Please click on the link to see the document in full.

MDBC Market Studies

[MDBC] Opportunities in the Malaysian ICT Sector for Dutch Business

In May 2021, the Malaysian Dutch Business Council with support of NLinBusiness presented the Market Study “Opportunities in the Malaysian ICT Sector for Dutch Business“, which mainly focused on 4 sub – sectors Big Data & AI, Cybersecurity, E – Commerce, and Cloud.

There are also in – depth reports available:

– a presentation slide deck (50 pages)

– the full report including references (135 pages)

These reports also contain a guide to doing business in Malaysia.

Dutch companies and entrepreneurs who are interested in receiving these reports are invited to write to MDBC at , including personal and company details.

Please click on the link above for the executive summary with infographics.

MDBC & Members

[Deloitte] Budget 2025 Snapshot

Themed ‘Reinvigorating the Economy, Driving Reforms, and Prospering the Rakyat,’ Budget 2025 unveiled the largest budget in history at RM421 billion, alongside a projected GDP growth of 4.5% to 5.5% and a fiscal deficit target of 3.8% of GDP. This is the third budget under the MADANI government, continuing its focus on widening the tax base, driving economic growth, strengthening governance, and protecting the well – being

of the rakyat.

From a tax perspective, Budget 2025 focuses on taxing higher – income groups, as evidenced by measures such as imposing sales tax on the importation of premium goods, service tax on fee – based banking services, and a 2% tax on dividend income exceeding RM100,000 received by individuals. The Prime Minister has noted that Malaysia’s tax – to – GDP ratio stands at just 12.6%, and is one of the lowest among its peers, highlighting the need to widen the tax base. The tax measures announced in Budget 2025 represent initial steps

toward this goal. Additionally, we anticipate increased tax audits to enhance tax collection in 2025. Therefore,

cultivating a strong culture of tax governance is essential moving forward.

Please click on the link to view the report in full.

[MDEC] Horizon: A Perspective of Malaysia’s Digital Economy

Horizon is a strategic digital economy publication aiming to showcase the vibrant growth trend in Malaysia’s digital economy, provide insight on trends and opportunities in Malaysia’s digital economy, and serve as the primary reference for both global and local stakeholders seeking reliable data, insights, and information on Malaysia’s digital landscape.

Unlock the Insights and Navigate the Digital Economy with Horizon

The digital economy is evolving at lightning speed, shaping industries and reshaping business landscapes. To navigate this dynamic realm, Horizon provides valuable insights and expert analysis that can guide your strategic decisions and fuel your success.

Introducing our comprehensive digital economy publication called Horizon, where thought leadership articles and cutting – edge analysis converge. We have gathered a diverse pool of industry visionaries, technological pioneers, and business experts to create a platform that fosters innovation, ideas, and inspires breakthroughs.

Please click on the link to view the report in full.

[MGTC] Green Practices Guidelines for the Services Sector

The development of green practice guidelines is a continuation of the implementation of the MyHIJAU Program under the Ministry of Environment and Water (KASA) and the Malaysian Green Technology and Climate Change Corporation (MGTC) which is a coordinating agency and secretariat for the program.

The development of Green Practice Guidelines is to provide guidance to the green industry in implementing green practices at the preliminary stage, during, and after construction is implemented. These guidelines also have an implementation direction to ensure that these Guidelines will continue to be referred to and used by all parties, especially industry players to help achieve the government’s goal of implementing green development in Malaysia.

These Guidelines are more towards the requirements that need to be put into practice so that industries, companies and organizations have green practice guidelines that can be referred to as well as help companies achieve the government’s goal of using green practices in line with SDG 12.6, which is to encourage the industry to use sustainable practices and integrate information sustainability into the reporting cycle.

Please click on the link to view the report in full.

[MGTC] Green Practices Guidelines for Livestock

The development of green practice guidelines is a continuation of the implementation of the MyHIJAU Program under the Ministry of Environment and Water (KASA) and the Malaysian Green Technology and Climate Change Corporation (MGTC) which is a coordinating agency and secretariat for the program.

The development of Green Practice Guidelines is to provide guidance to the green industry in implementing green practices at the preliminary stage, during, and after construction is implemented. These guidelines also have an implementation direction to ensure that these Guidelines will continue to be referred to and used by all parties, especially industry players to help achieve the government’s goal of implementing green development in Malaysia.

These Guidelines are more towards the requirements that need to be put into practice so that industries, companies and organizations have green practice guidelines that can be referred to as well as help companies achieve the government’s goal of using green practices in line with SDG 12.6, which is to encourage the industry to use sustainable practices and integrate information sustainability into the reporting cycle.

Please click on the link to view the report in full.

[MGTC] Green Practices Guidelines for Agriculture & Plantation

The development of green practice guidelines is a continuation of the implementation of the MyHIJAU Program under the Ministry of Environment and Water (KASA) and the Malaysian Green Technology and Climate Change Corporation (MGTC) which is a coordinating agency and secretariat for the program.

The development of Green Practice Guidelines is to provide guidance to the green industry in implementing green practices at the preliminary stage, during, and after construction is implemented. These guidelines also have an implementation direction to ensure that these Guidelines will continue to be referred to and used by all parties, especially industry players to help achieve the government’s goal of implementing green development in Malaysia.

These Guidelines are more towards the requirements that need to be put into practice so that industries, companies and organizations have green practice guidelines that can be referred to as well as help companies achieve the government’s goal of using green practices in line with SDG 12.6, which is to encourage the industry to use sustainable practices and integrate information sustainability into the reporting cycle.

Please click on the link to view the report in full.

[MGTC] Green Practices Guidelines for Manufacturing

The development of green practice guidelines is a continuation of the implementation of the MyHIJAU Program under the Ministry of Environment and Water (KASA) and the Malaysian Green Technology and Climate Change Corporation (MGTC) which is a coordinating agency and secretariat for the program.

The development of Green Practice Guidelines is to provide guidance to the green industry in implementing green practices at the preliminary stage, during, and after construction is implemented. These guidelines also have an implementation direction to ensure that these Guidelines will continue to be referred to and used by all parties, especially industry players to help achieve the government’s goal of implementing green development in Malaysia.

These Guidelines are more towards the requirements that need to be put into practice so that industries, companies and organizations have green practice guidelines that can be referred to as well as help companies achieve the government’s goal of using green practices in line with SDG 12.6, which is to encourage the industry to use sustainable practices and integrate information sustainability into the reporting cycle.

Please click on the link to view the report in full.

General

EUROCHAM: CSO Roundtable Dialogue – Sustainability in Manufacturing

On 12 September, EUROCHAM organized the Chief Sustainability Officer (CSO) Roundtable Dialogue on Sustainability in Manufacturing. The dialogue focused on three topics:

1. Renewable Energy;

2. Circularity in Manufacturing; and

3. Hydrogen Economy.

Please click on the link above to view the full report.

Click here to read the CSO Roundtable Dialogue Feedback Survey.

National Industrial Masterplan (NIMP) 2030

The New Industrial Master Plan 2030 (NIMP 2030) aims to increase the manufacturing’s value – added by 6.5% to RM587.5 billion by 2030, derived from the master plan’s interventions for high – impact sectors, Prime Minister Datuk Seri Anwar Ibrahim said on 1 September. The high – impact sectors include electrical and electronics (E&E), chemical, electric vehicle, aerospace, and pharmaceutical.

Click here to read / download the NIMP media release.

Click here to read / download the Prime Minister’s Speech on the NIMP 2030.

Click here to read / download the summary of the NIMP 2030.

Click here to read / download the NIMP 2030.

National Energy Transition Roadmap (NETR)

On 27 July 2023, the Malaysian government launched the National Energy Transition Roadmap (NETR) Phase 1 to accelerate Malaysia’s energy transition. NETR is critical in supporting:

- The Twelfth Malaysia Plan 2021 – 2025 which outlines aspirations for the nation to achieve net zero emissions by 2050;

- The National Energy Policy (DTN) launched in September 2022 with aspirations to become a low carbon nation in 2040.

NETR is also crucial in navigating the complexity of energy transition on a large scale, especially the shift from a traditional fossil fuel – based economy to a high – value green economy.

Please click on the link to read or download the report in full.

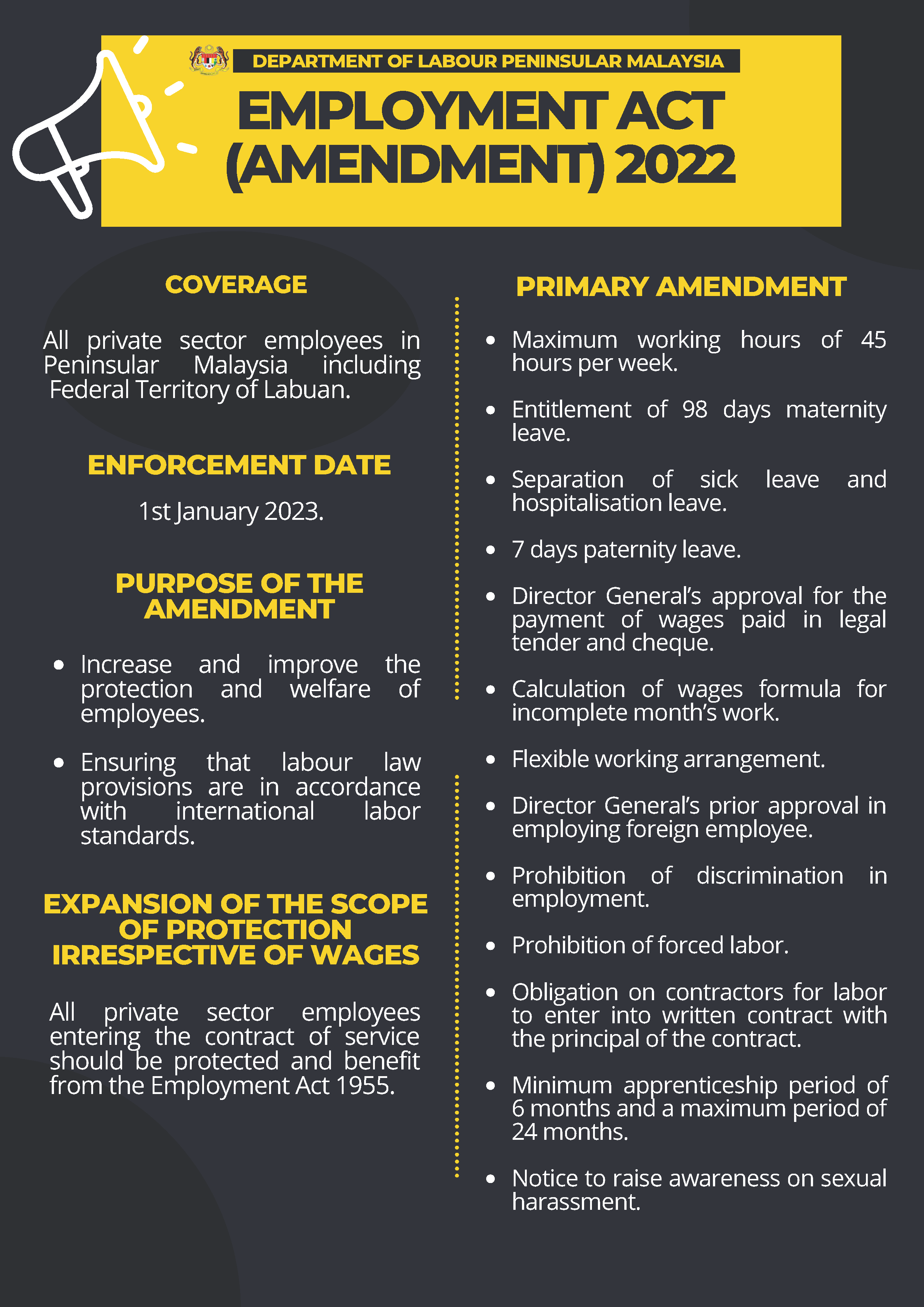

Amendments to Employment Act

Amendments to the Employment Act 1955 came into force on Jan 1, 2023. Key amendments include the extension of maternity leave allocations from 60 days to 98 days, reduced weekly working hours from 48 to 45 hours, and a seven – day paternity leave for married male employees.

– News: Amendments to Employment Act comes into force Jan 1

– The official gazette: ACT A1651 EMPLOYMENT (AMENDMENT) ACT 2022

– Summary PDF: Employment Act (Amendment) 2022 (may be viewed below)

12th Malaysia Plan

The 12th Malaysia Plan has been announced by the government.

Click here to read the document in BM

Click here to read the document in English

Click here for the Executive Summary

Click here for the infographic / pamphlet

Click here for the PM’s speech in BM

Click here for the PM’s speech in English

For more information on the 12th Malaysia Plan, please visit rmke12.epu.gov.my/en

MDBC (Virtual Backgrounds)

ZOOM Virtual Backgrounds MY II

Please click on the relevant background to view / download your copy.

ZOOM Virtual Backgrounds MY III

Please click on the relevant background to view / download your copy.

Please note: The information provided on this page Infographics & Reports is for general information purposes only. Content not created by MDBC will be marked / credited as such. They were prepared or accomplished by the credited author / organization and the opinions expressed in those articles published here are the author’s own and do not reflect the view of the Malaysian Dutch Business Council (MDBC).

© Copyright MDBC 2023. All rights reserved. All information contained in ‘MDBC Infographics & Reports‘ is intended for the viewer’s own personal reference. Use of individual infographics or reports for distribution or reproduction MUST credit MDBC and be reproduced accurately and in full, without modifications.

The full disclaimer for MDBC Infographics & Reports is available at The Library.