ARCHIVE

Infographics, Backgrounds, & Reports

MDBC has created and curated infographics, virtual backgrounds, and reports for members to aid them in their business pursuits. Content not created by MDBC will be marked / credited as such.

MDBC & Members

MDBC Membership Satisfaction Survey 2023

Results from the MDBC Member Satisfaction Survey 2023. Feedback given by members on each section of the Membership satisfactions survey (MSS) contains both positive as well as constructive feedback. We thank you all for sharing you thoughts on how MDBC can continue to improve.

Please click on the link to see the infographic in full.

[MDEC] National e – Invoicing Initiative

The National e – Invoicing initiative aims to drive interoperable e – invoicing by digitalizing how businesses send invoices to other businesses, allowing different accounting software and Enterprise Resource Planning (ERP) systems to send and receive e – Invoices in a system – to – system manner.

Please click on the link to view the infographic in full.

[CMM] SEDG ESG Disclosure Guide

As part of the RBC Working Group meeting on 4 October, participants received a briefing on the SEDG Guide. The SEDG is a guide to help your company decide what Environmental, Social and Governance (ESG) disclosures to track and report. It seeks to provide a simple and standard way for Malaysian SMEs in supply chains to disclose on ESG.

The SEDG covers indicators that can be tracked and disclosed to measure ESG progress, as well as provide for different levels of adoption. The guidance structure of the disclosures consists of most referenced topics in ESG disclosures. The Guide provides the metrics needed to track progression in each 15 topics and identifies 35 disclosures in selected standards that correlate to chosen disclosures. The SEDG also offers additional guidance to provide SMEs additional information to further guide on the requirements of the disclosure.

Please click on the links below to download the SEDG Guide and supporting documents:

* Simplified ESG Disclosure Guide

* SEDG Additional Guidance

* SEDG Disclosure Guidance

* SEDG Template

[TMF Group] The Global Business Complexity Index 2023

Insights to cut through the complexity of operating and investing around the world.

Entering into new markets, or managing existing cross – border operations, can pose many challenges for businesses. This report helps you to cut through the layers of corporate compliance complexity, wherever you operate. Based on exhaustive proprietary research and TMF’s analysis of over 22,000 data points, the Global Business Complexity Index provides an authoritative overview of the complexity of establishing and operating businesses around the world.

The analysis identifies key trends and sheds light on how business complexity affects three core areas of business administration:

- Accounting and tax

- Global entity management

- HR and payroll

Download the report to discover:

- Which jurisdictions rank as the most complex – or the simplest – based on their business environments.

- The impact of geopolitical and economic factors such as inflation and conflict on businesses’ growth and expansion plans.

- How global compliance requirements are evolving and the consequences for the attractiveness of jurisdictions around the world.

- The increasing importance of ESG considerations and how these are being incorporated into business practices.

Please click on the link to read the report in full.

[MIDA] First Half 2023 Investments Inflow into Malaysia to Generate Over 50,000 Jobs

Malaysia has attracted a total of RM132.6 billion (USD28.4 billion) worth of approved investments in the services, manufacturing and primary sectors involving 2,651 projects from January to June 2023 and is expected to create 51,853 job opportunities in the country.

Singapore is the leading source of FDI with approved investments totaling RM13.7 billion (USD2.9 billion). The nation has also attracted quality investments from other countries, such as Japan (RM9.1 billion) (USD2.0 billion), The Netherlands (RM9.0 billion) (USD1.9 billion), the People’s Republic of China (PRC) (RM8.4 billion) (USD1.8 billion), and British Virgin Islands (RM7.1 billion) (USD1.5 billion).

Please click on the link to read the report in full.

Please click here to view the infographic.

[MDEC] Horizon: A Perspective of Malaysia’s Digital Economy

Horizon is a strategic digital economy publication aiming to showcase the vibrant growth trend in Malaysia’s digital economy, provide insight on trends and opportunities in Malaysia’s digital economy, and serve as the primary reference for both global and local stakeholders seeking reliable data, insights, and information on Malaysia’s digital landscape.

Please click on the link to read the report in full.

[Randstad] 2023 Market and Salary Report

Randstad, the world’s leading human resources solutions agency, has released the 2023 Job Market and Salary Trends Report to provide employers and job seekers with new talent insights and salary benchmarks in Malaysia.

The 2023 Job Market and Salary Trends report anticipates talent and skills developments in pinpointed industries:

Technology – Adopting a more prudent recruitment and workforce management approach, driving talent demand in cloud computing, cybersecurity, artificial intelligence, the Internet of Things (IoT), virtual reality (VR), and blockchain.

Manufacturing – Demand for technical and commercial talent continues as organizations push their I4.0 digital transformation forward, in automation, digitalization, and experiences.

Construction – Commercial property and infrastructure developments will create more high – value skilled jobs for the local workforce, which may be slowed down by the persistent skills gap.

Please click on the link to read the report in full.

MDBC 8 Ways to Get More Out of Your Council Membership

There are many reasons to join the Malaysian Dutch Business Council (MDBC). There are networking opportunities, community involvement, and the trust that affiliation with our Business Council builds within the market. There are many additional benefits that you can receive from being an MDBC member, but sometimes, our members need extra support to get the maximum benefit out of this community. It’s easy to assume that by simply paying the annual membership dues, new business opportunities, potential joint ventures, and higher brand recognition will occur. In order to help you maximize your benefits and make the MDBC experience work for you, learn how to get the most out of your membership.

Please click on the link to see the document in full.

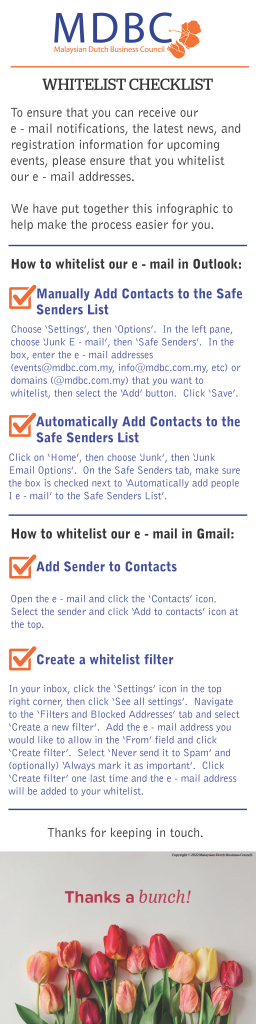

MDBC Whitelist Checklist

To ensure that you can receive all of our e – mails, please make sure that you whitelist our addresses and domain. Need help doing that? We’ve put together a simple, easy to read whitelist checklist for you to follow.

MDBC: Membership Satisfaction Survey 2022 Summary Results

Results from the MDBC Membership Satisfaction Survey (MSS) 2022. Feedback given by members on each section of the MSS contains both positive as well as constructive feedback. We thank you all for sharing your thoughts on how MDBC can continue to improve.

Please click on the link to see the infographic in full.

[InvestKL] Breaking New Ground: Sustainability in Malaysia

The report by MIT Technology Review Insights highlights what global companies in Greater KL — and Malaysia as a whole — are doing to achieve their ESG targets

InvestKL Corporation (“InvestKL”) launched “Breaking New Ground: Sustainability in Malaysia,” a sustainability-themed report developed in collaboration with the Massachusetts Institute of Technology (“MIT”) Technology Review Insights recently. The report is based on interviews with sustainability experts and senior executives from leading global companies in Greater Kuala Lumpur (“KL”). It highlights how they drive sustainability values by incorporating environmental, social, and governance (“ESG”) principles into their core businesses, and how their local experience could be applied globally.

The key findings of the report are:

1. Malaysia is committed to becoming a regional decarbonisation leader through its deep, globally integrated industry clusters and supply chains to develop new, greener business processes and less carbon-intensive manufacturing and logistics processes.

2. Greater KL has experienced a significant increase in “greening” opportunities for some of the country’s conventional innovation clusters, particularly in oil and gas, energy, IT outsourcing and other digital economy sectors.

3. Malaysia’s growing sustainability stance is creating a culture of monitoring, measurement and accountability that can serve as a framework for ESG-minded companies.

Please click on the link to read the report in full.

[Henry Goh & Co] The Budapest Treaty in Malaysia and New Directives

On 31 March 2022, Malaysia deposited the instrument of ratification at the World Intellectual Property Organization (WIPO) Headquarters in Geneva and officially acceded to the Budapest Treaty on the International Recognition of the Deposit of Microorganisms for the Purposes of Patent Procedure. This brings the total number of contracting parties of the Budapest Treaty to 86 (as of 15 July 2022). Following the deposit, the related provisions in the Patents (Amendment) Act 2022 i.e., Sections 26C and Subsection 78O(1A) came into force on 30 June 2022.

The Malaysian IP Office has also issued several directives on 30 June 2022. A raft of new official forms is now available incorporating matters relating to the deposition of microorganisms in view of the enforcement of the Budapest Treaty provisions. There is a grace period up to 31 July 2022 within which the old forms may still be used.

Please click on the link to read the report in full.

[Henry Goh & Co] Pursuing IP Protection in a Pandemic – Malaysian Utility Innovation Certificate

Report by Alvin Boey

As the world continues to grapple with the COVID – 19 pandemic, it is business as usual for innovators to develop new inventions, technologies, and solutions since innovation does not stop. Intellectual Property continues to play an indispensable role in providing a solid platform for development, research, analysis, and commercialization of new innovations meeting the challenges in the current pandemic. Without a shadow of doubt that it will be very difficult and challenging to innovate and invent if these new ideas and assets are not protected.

Many intellectual property owners often overlook the pursuance of utility model protection, as compared to a full – fledged patent protection due to various reasons. Many new inventions are cumulative and incremental in nature and the patent system may not be able to accommodate them with its more stringent requirements, namely novelty and inventive step.

Please click on the link to read the report in full.

[Standard Chartered] Critical Indicators of Sustainable Supply Chains

A new report “Critical indicators of sustainable supply chains” from Standard Chartered reveals a significant gap between intent and action as companies expand the indicators beyond ESG. More than 900 companies globally identified financial robustness, collaboration and connectedness, flexibility and adaptability as well as environmental soundness as the factors to focus on to future proof their supply chains. What are the weakest links? What are the opportunities?

Please click on the link to read the full report

[KPMG] Ransomware: The 2nd Pandemic

Ransomware may have started over 30 years ago but first gained global notoriety as a result of the WannaCry attack in May 2017. However, it was not until the global COVID – 19 pandemic where the number of ransomware attacks skyrocketed. The Chainanalysis 2021 Crypto Crime Report indicated that in 2020 cybercriminals profited an estimated US$350M from ransomware alone, an increase of 311% from 2019. Business leaders in every organization must be proactive to mitigate the risks.

Please click on the link to read the article in full.

[KPMG] Ignore OT cyber risks at your peril

What would life be like without traffic lights, mass – produced food, electricity at the touch of a button, water supply, or easily available petrol and gas? Operational Technology (OT) makes these possible and pervades our lives in obvious and hidden ways. It automatically monitors and controls processes and equipment that are too dangerous, too demanding or too monotonous for manual operation.

Modern day OT networks run today’s society as we know it, and we’ve taken these conveniences for granted to always be readily available and safe to use. Hence, it is a smart and malicious criminal who knows that targeting OT infrastructures will make us vulnerable.

Please click on the link to read the article in full.

Many organizations are now racing to adopt new technologies and digitalize processes to improve productivity, reduce cost, and increase competitive advantage. However, I’ve observed how companies tend to overlook the human risk factor in this accelerated technology transformation race.

The result is predictable: Organizations become more vulnerable to cyber criminals who engage increasingly sophisticated social engineering techniques that exploit their personnel’s behavior.

Please click on the link to read the article in full.

[InvestKL] Virtual Tour of Greater KL Business Hubs

Virtual tours of Greater KL Business Hubs are now live on the InvestKL website. Explore three business hubs: KL City Centre, Bangsar South, and Cyberjaya with more business hubs on the way.

Please click on the link to start your tour now.

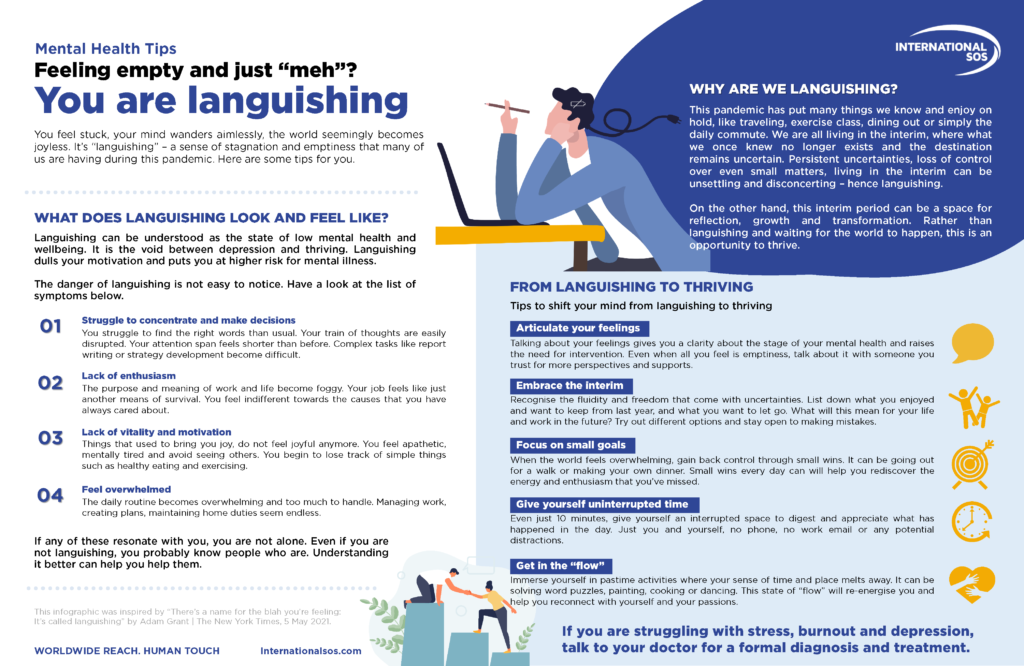

[InternationalSOS] Mental Health Tips

[Randstad Malaysia] Workmonitor Report 2020 2H

Randstad Malaysia released the latest local results from the Randstad Workmonitor 2020 2H survey. In the latest survey, they looked at how the COVID – 19 pandemic has changed the workforce’s viewpoints and expectations on upskilling. The survey was conducted in October 2020 and the minimum sample size is 400 per market.

Key findings in Malaysia include:

– 61% of respondents said that it has been a struggle to acquire new skills to adapt to the COVID-19 pandemic. Younger workers faced more difficulties doing so than mature employees.

– 7 in 10 respondents believe that employers will have trouble finding the right talent in the future.

– 55% said it is important that their employers create an inclusive work environment where they can safely share and receive feedback.

Please click on the link to read the report in full.

[27 Group] 4IR Fourth Industrial Revolution

The Ministry of International Trade and Industry (MITI) launched the National Industry 4.0 Policy Framework (Industry4WRD) in 2018, on the adoption of Industry 4.0 technology elements for the manufacturing sector and manufacturing – related services. There was a need to develop a broader 4IR policy framework for the rest of the economy to interphase with the Industry4WRD framework. In addition, a multitude of current policies that direct sectoral growth must be reconciled within a wider structure for improved resource optimization and alignment of execution. It is with these circumstances we were engaged by the Client with another international consultancy firm to devise the national policy framework.

Please click on the link to read the full report.

[Rabobank] ASEAN update: Recovering from COVID – 19

We have left 2020 in the rear view mirror and are looking forward to getting back to “normal”. Unfortunately, the coronavirus is still very much influencing our lives and the world economy. While scientists have learned quite a bit about the “original” virus, there remains much uncertainty about new virus mutations like the “South African” and “British” variant. The result is that 2021 will again be a year marked by the fight against the coronavirus.

Please click on the link to read the report in full.

[InvestKL] Performance Report 2020

Invest KL Corporation (InvestKL) is an investment promotion agency tasked to attract global multinational corporations (MNCs) to set up regional hubs in the Greater Kuala Lumpur (Greater KL) area in Malaysia, one of Asia’s most investor-friendly countries.

Looking ahead, InvestKL will extend its sights to the next 100 MNC investors in Greater KL, with a focus on high-tech, high-impact and high-value investments that will support Malaysia’s path towards embracing Industry 4.0. Foreign investors benefit from InvestKL’ s investment facilitation acumen in formulating competitive fiscal packages, recommending investment sites, ensuring a pipeline of highly-skilled local talents, as well as fast-tracking expatriate and business relocations.

Please click on the link to read the report in full.

MDBC: Membership Satisfaction Survey 2020 Summary Results

Results from the MDBC Membership Satisfaction Survey (MSS) 2020. Feedback given by members on each section of the MSS contains both positive as well as constructive feedback. We thank you all for sharing your thoughts on how MDBC can continue to improve.

Please click on the link to see the infographic in full.

[International SOS] Risk Outlook 2021 Predictions Paper

For the fifth year in a row, International SOS are proud to have developed the Risk Outlook report alongside Ipsos MORI. 2020 has shown that, on its own, the past is a poor guide to the future. But armed with this expert analysis and insight, leaders will be better equipped to navigate the uncertain times ahead.

Please click on the link to read the report in full.

The Minister of Finance, YB Dato’ Sri Tengku Zafrul bin Tengku Abdul Aziz, tabled the 2021 Budget on 6 November 2020. Here, KPMG has unpacked the Budget’s key proposals and provide insights and analyses on the implications to you and your organization.

Please click on the link to read the report in full.

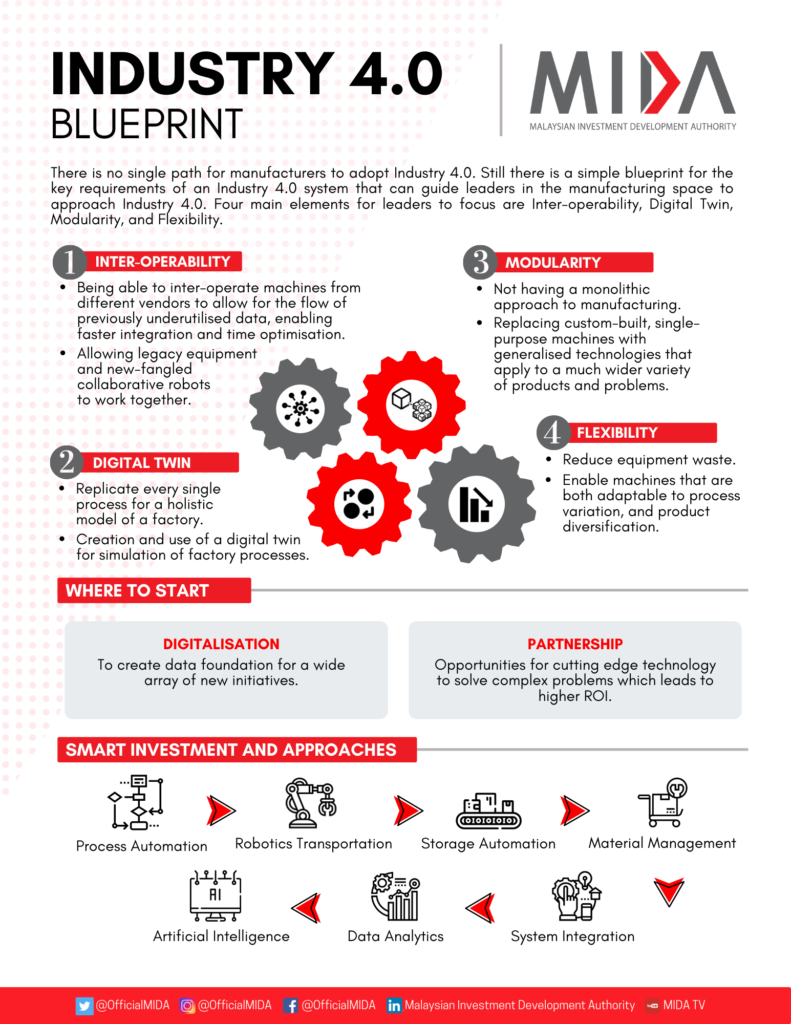

[MIDA]: Industry 4.0 Blueprint

Please click on the infographic above to download a copy for your own reference.

[Vriens & Partners] Malaysia’s 2020 Cabinet

Malaysia’s cabinet compromise: Allies rewarded, rivals kept at bay…for now. Fundamentally, Muhyiddin Yassin’s cabinet is a grand compromise designed to appease key factions and keep potential rivals at bay, with some “technocratic” appointments thrown in to generate some goodwill.

Please click on the link to read the report in full.

[Sunway Medical] How to Wear a Mask

Please click on the infographic above to download a copy for your own reference.

[Sunway Medical] COVID – 19 General Info

Please click on the infographic above to download a copy for your own reference.

MDBC: Member Satisfaction Survey 2019 Summary Results

Results from the MDBC Member Satisfaction Survey 2019. Feedback given by members on each section of the Membership satisfactions survey (MSS) contains both positive as well as constructive feedback. We thank you all for sharing you thoughts on how MDBC can continue to improve.

Please click on the link to see the infographic in full.

[TMF Group] Malaysia Ranked 25th for Global Business Complexity

Malaysia is the ninth simplest place to do business in Asia (excluding Australia & Oceania), according to

a new report by TMF Group, a leading provider of international administrative services.

Please click on the link to read the report in full.

[Skrine] Highlights of the Prime Minister’s Keynote Address at the Invest Malaysia Conference 2019

The Prime Minister of Malaysia, Tun Dr. Mahathir bin Mohamad, delivered the keynote address at the Invest Malaysia Conference 2019 on 19 March.

Please click on the link to read the report in full.

MDBC: Member Satisfaction Survey 2018 Summary Results

Results from the MDBC Member Satisfaction Survey 2018. Feedback given by members on each section of the Membership satisfactions survey (MSS) contains both positive as well as constructive feedback. We thank you all for sharing you thoughts on how MDBC can continue to improve.

Please click on the link to see the infographic in full.

[MDEC] Malaysia – The Fastest Growing Region in the World

Malaysia presents the perfect platform and ecosystem to fuel digital economy growth. Located at the heart of ASEAN, the country is an ideal and cost-effective gateway to access the region’s population base of 640 million with a collective Gross Domestic Product (GDP) of US$2.5 trillion

Please click on the link to read the report in full.

Report on the Implementation and Outcomes of Work – Life Practices in Corporate Malaysia. TalentCorp has commissioned this study to explore corporate Malaysia’s perception on the Future of Work, and the extent and outcomes of work – life practice implementation.

Please click on the link to read the report in full.

[Vriens & Partners] Report on Malaysia’s 14th General Elections

In an outcome that surprised everyone, the opposition coalition led by Dr Mahathir Mohamad won the majority of the Parliamentary seats, enabling him to form the next Federal Government. It is unlikely that the incoming Federal administration will pursue policies that will lead to an unfriendly business environment. In the states of Penang and Selangor, the PH governments have continued to pursue business friendly policies since winning the states in 2008.

Please click on the link to read the report in full.

[Vriens & Partners] Malaysian Election 2018

Around noon today, Prime Minister Najib announced the dissolution of Malaysia’s Parliament, effective tomorrow, paving the way for the 14th General Election. The election date is expected to be announced within a week.

Please click on the link to read the report in full.

General

EUROCHAM: CSO Roundtable Dialogue – Sustainability in Manufacturing

On 12 September, EUROCHAM organized the Chief Sustainability Officer (CSO) Roundtable Dialogue on Sustainability in Manufacturing. The dialogue focused on three topics:

1. Renewable Energy;

2. Circularity in Manufacturing; and

3. Hydrogen Economy.

Please click on the link above to view the full report.

Click here to read the CSO Roundtable Dialogue Feedback Survey.

National Industrial Masterplan (NIMP) 2030

The New Industrial Master Plan 2030 (NIMP 2030) aims to increase the manufacturing’s value – added by 6.5% to RM587.5 billion by 2030, derived from the master plan’s interventions for high – impact sectors, Prime Minister Datuk Seri Anwar Ibrahim said on 1 September. The high – impact sectors include electrical and electronics (E&E), chemical, electric vehicle, aerospace, and pharmaceutical.

Click here to read / download the NIMP media release.

Click here to read / download the Prime Minister’s Speech on the NIMP 2030.

Click here to read / download the summary of the NIMP 2030.

Click here to read / download the NIMP 2030.

National Energy Transition Roadmap (NETR)

On 27 July 2023, the Malaysian government launched the National Energy Transition Roadmap (NETR) Phase 1 to accelerate Malaysia’s energy transition. NETR is critical in supporting:

- The Twelfth Malaysia Plan 2021 – 2025 which outlines aspirations for the nation to achieve net zero emissions by 2050;

- The National Energy Policy (DTN) launched in September 2022 with aspirations to become a low carbon nation in 2040.

NETR is also crucial in navigating the complexity of energy transition on a large scale, especially the shift from a traditional fossil fuel – based economy to a high – value green economy.

Please click on the link to read or download the report in full.

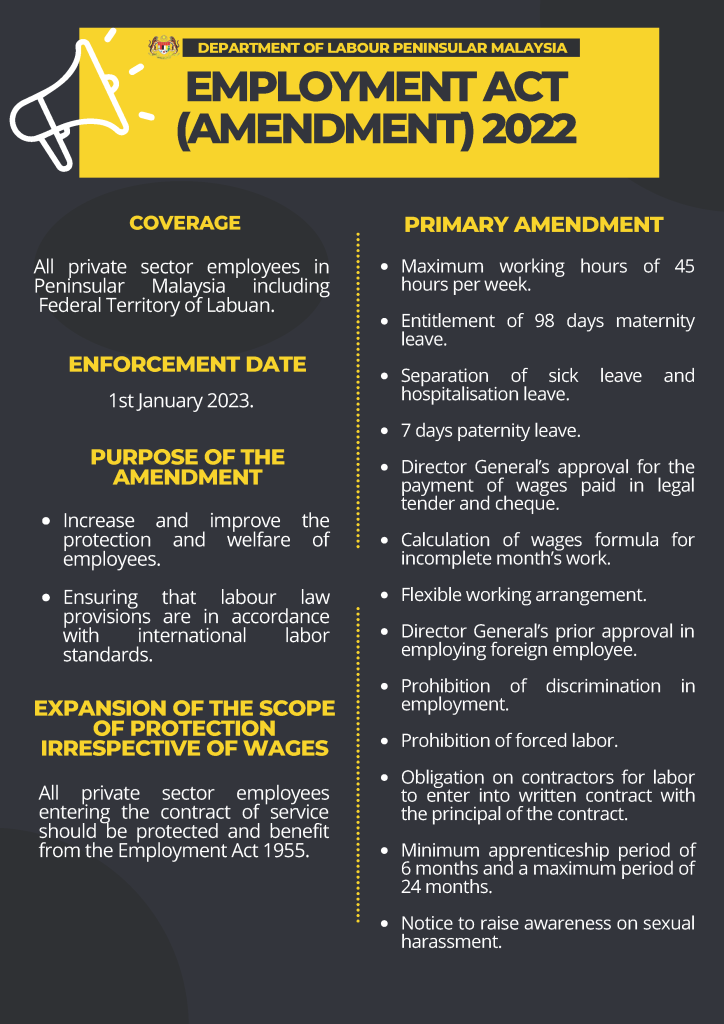

Amendments to Employment Act

Amendments to the Employment Act 1955 came into force on Jan 1, 2022. Key amendments include the extension of maternity leave allocations from 60 days to 98 days, reduced weekly working hours from 48 to 45 hours, and a seven – day paternity leave for married male employees.

– News: Amendments to Employment Act comes into force Jan 1

– The official gazette: ACT A1651 EMPLOYMENT (AMENDMENT) ACT 2022

– Summary PDF: Employment Act (Amendment) 2022 (may be viewed below)

12th Malaysia Plan

The 12th Malaysia Plan has been announced by the government.

Click here to read the document in BM

Click here to read the document in English

Click here for the Executive Summary

Click here for the infographic / pamphlet

Click here for the PM’s speech in BM

Click here for the PM’s speech in English

For more information on the 12th Malaysia Plan, please visit rmke12.epu.gov.my/en

Malaysia’s Digital Economy Blueprint 2021

Prime Minister Tan Sri Muhyiddin Yassin has unveiled the country’s digital economy blueprint in a bid to catch up in the digitalisation race. The 10 year road map aims to transform Malaysia into a digitally driven, high income nation and a regional leader in the digital economy.

Click here to download the Digital Economy Blueprint in BM

Click here to download the Digital Economy Blueprint in English

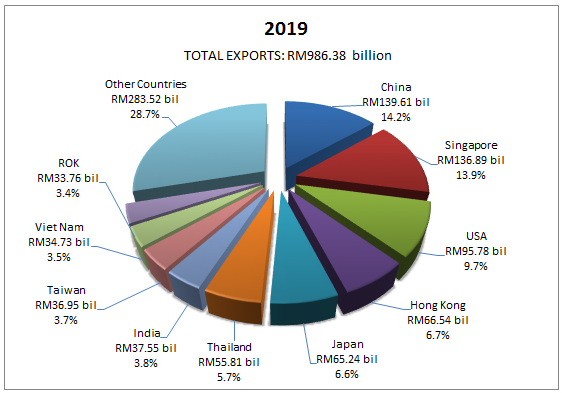

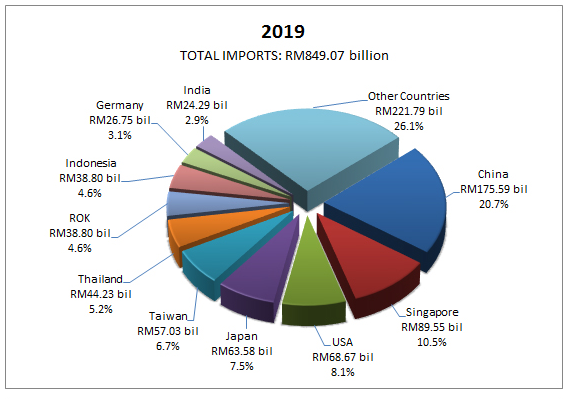

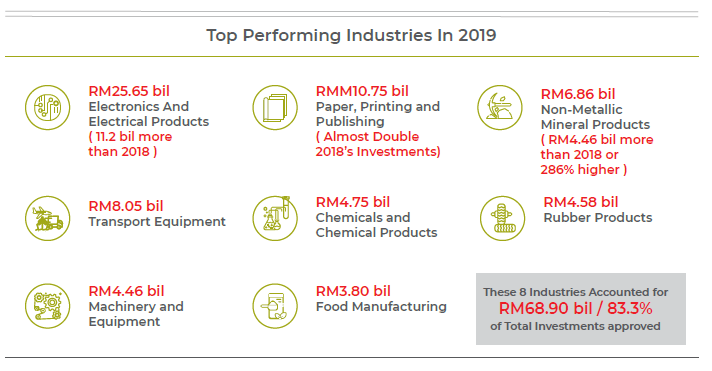

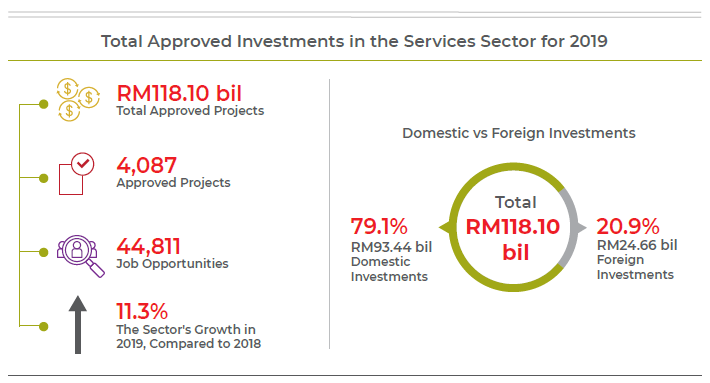

[MIDA] Malaysia: Key Trade and Investment Figures 2019

Source: MIDA

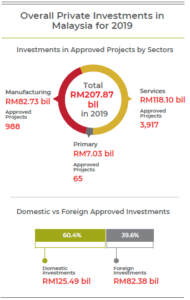

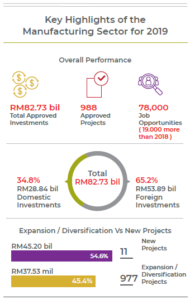

[MIDA] Malaysia: Investment Performance 2019

Malaysia has been proactive during the Movement Control Order (MCO) in balancing public health and the livelihood of the people as well as strengthening the economic fundamentals by providing the necessary approval for companies in several economic sectors to operate, and are subject to strict adherence to health and safety guidelines.

“While the COVID – 19 pandemic has changed the global industrial system, MITI is committed to ensuring that Malaysia continues to be positioned as an investor – friendly location for long term growth of both foreign and domestic businesses. Foreign direct investment (FDI) is a long term capital flow. We trust that the existing foreign companies will continue to weather the storm and retain their investment in the country,” said YB Dato’ Seri Mohamed Azmin Ali, Senior Minister and Minister of International Trade and Industry (MITI), today.

Against the backdrop of a challenging external environment and declining global FDI inflows, Malaysia remains resilient and attracted a total of RM 207.9 billion of approved investments in the manufacturing, services and primary sectors in 2019, a 1.7% increase, compared to 2018. With a contribution of 60.4% (RM 125.5 billion), domestic direct investment (DDI) accounted for the bulk of the total approved investments. Although FDI made up for 39.6% (RM 82.4 billion) of the total, the value of FDI in 2019 had increased by 2.9% from the previous year.

Please click here for the full media release in English.

Please click here for the full media release in BM.

Please click here for the presentation slides.

Please click here for the full report.

Source: MIDA

Please click on the infographic above to download a copy for your own reference.

Please click on the infographic above to download a copy for your own reference.

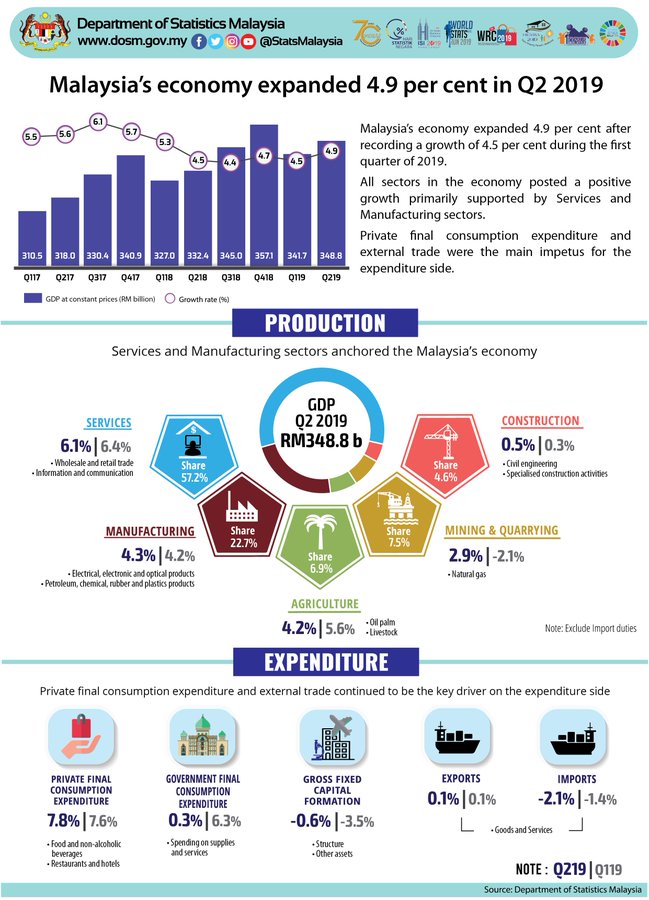

[DOSM] Malaysia’s Economy 2019

Malaysia’s economy expanded 4.9% in Q2 2019.

Source: Department of Statistics Malaysia

For more information, please visit www.dosm.gov.my

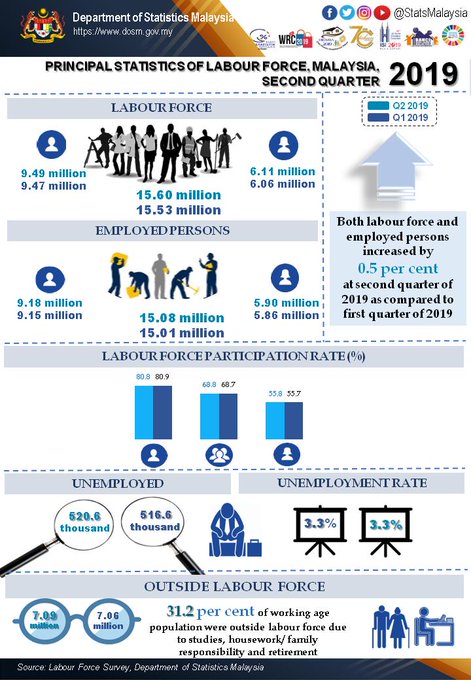

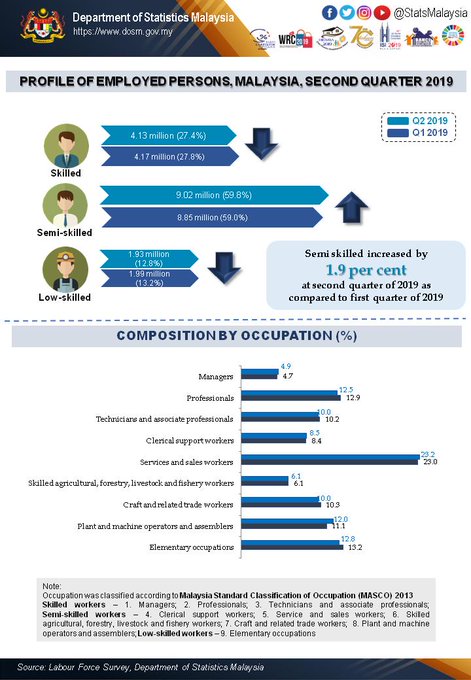

[DOSM] Malaysia’s Labour Force Q2 2019

The Labour force in Malaysia increased 0.5% to 15.6 million persons in Q2 2019.

Source: Department of Statistics Malaysia

For more information, please visit www.dosm.gov.my

The World Bank: Doing Business 2019

Doing Business 2019: Training for Reform, a World Bank Group flagship publication, is the 16th in a series of annual reports measuring the regulations that enhance business activity and those that constrain it. Doing Business presents quantitative indicators on business regulations and the protection of property rights that can be compared across 190 economies—from Afghanistan to Zimbabwe—and over time.

Malaysia has climbed up to the 15th position in the World Bank Doing Business 2019 Report from its 24th position the year before. Six reforms in Malaysia were measured by Doing Business, resulting in the second highest regional improvement in the ease of doing business score. Refer to ph 143 of the report.

Author: Doing Business

Please click on the link to see the report in full.

[Regus] GDPR Experts Explain How to Protect Data on the Move

How safe is your company’s data outside your office? The General Data Protection Regulation (GDPR) comes into effect this month, affecting any organization worldwide that collects or processes personal data on EU residents. Here, GDPR compliance experts advise you how to protect your business.

Please click on the link to read the report in full.

[Regus] Not Just a Fad: What Blockchain Means for Business

Tired of reading about blockchain? Don’t give up just yet: the technology is creating opportunities to fundamentally rethink how we work, what we do, and where we do it. Hannah Hudson explores its potentially disruptive impact, and what it means for flexible working.

Please click on the link to read the report in full.

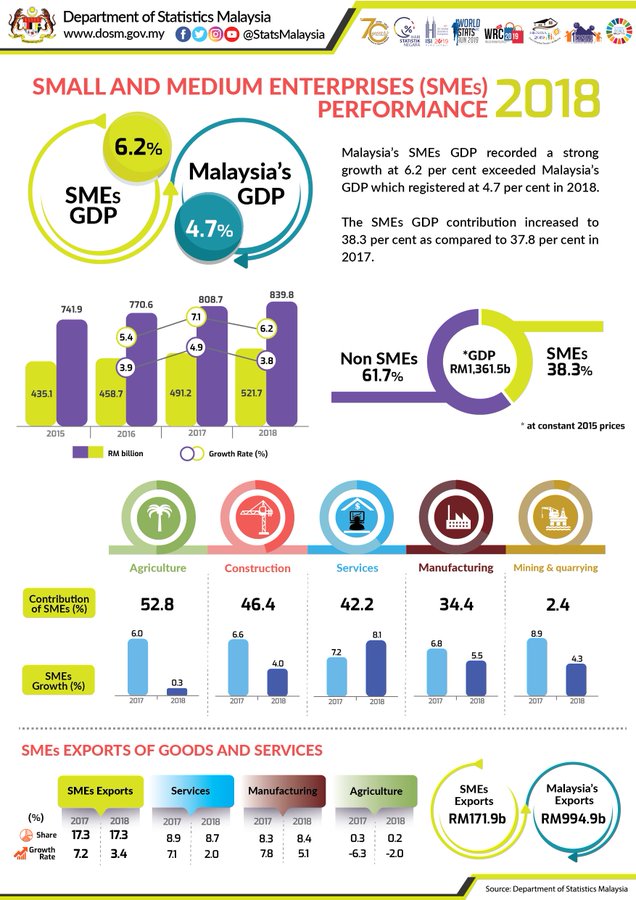

[DOSM] Malaysia’s SMEs Performance 2018

Malaysia’s SMEs GDP recorded a strong growth at 6.2%, exceeding Malaysia’s GDP which registered at 4.7% in 2018. The SMEs GDP contribution increased to 38.3% compared to 37.8% in 2017.

Source: Department of Statistics Malaysia

For more information, please visit www.dosm.gov.my

[MATRADE] Malaysia’s Trade Performance 2018

Largest Trade Surplus since 2012 as Exports reached almost RM1 trillion in 2018

Supported by stronger than expected export growth, Malaysia’s total trade in 2018 remained resilient, expanding by 5.9% to RM 1.876 trillion, compared with RM 1.771 trillion in 2017.

Despite the uncertainties in the global environment, exports rose by 6.7% to reach a value of RM 998.01 billion, surpassing the forecast export growth of 4.4% in the Economic Outlook 2019. Imports increased by 4.9% to RM 877.74 billion.

Malaysia’s trade surplus widened by 22.1% to RM 120.27 billion, registering the fastest rate in 10 years and the largest trade surplus since 2012. This was the 21st consecutive year of trade surplus since 1998.

Author: MATRADE

Please click on the link to see the report in full.

[EU Commission] EU – ASEAN Blue Book 2018

The relationship between the European Union and the Association of Southeast Asian Nations is built on strong foundations. Relations have grown over time and encompass today a broad spectrum of social, political, economic, trade, developmental, and security dimensions. Dialogue and cooperation are the basis of the EU-ASEAN partnership. The EU is one of ASEAN’s longstanding dialogue partners and one of ASEAN’s main development partners, both at regional and bilateral levels.

EU regional and bilateral development assistance focuses on areas where the EU and ASEAN can work together to counter negative trends. They set their sights high on regional economic integration for reducing the development gap, on biodiversity conservation, improved border management and migration, and better and more mobile higher education. These are only few examples of joint efforts to achieve tangible results for all citizens. The EU – ASEAN Blue Book demonstrates the success and benefits of close cooperation and that by joining forces, it will contribute to prosperity, stability and security for all.

Author: The European Union Commission

Please click on the link to see the report in full.

Please note: The information provided on this page Infographics & Reports is for general information purposes only. Content not created by MDBC will be marked / credited as such. They were prepared or accomplished by the credited author / organization and the opinions expressed in those articles published here are the author’s own and do not reflect the view of the Malaysian Dutch Business Council (MDBC).

© Copyright MDBC 2021. All rights reserved. All information contained in ‘MDBC Infographics & Reports‘ is intended for the viewer’s own personal reference. Use of individual infographics or reports for distribution or reproduction MUST credit MDBC and be reproduced accurately and in full, without modifications.

The full disclaimer for MDBC Infographics & Reports is available at The Library.